Sharenet is proud to present Sharenet Analytics, the JSE Investments Research House that delivers their findings in an easy and simple manner to make trading child's play. Invest in shares based on tried and tested, successful mechanical stock picking strategies which have been optimised for trading on the JSE. It couldn't be made any simpler - Sharenet Analytics does the hard analytical work and you simply trade on the findings.

Sharenet Analytics also provides long, medium & short-term mechanical market timing to enable clients to significantly reduce their risks and boost performance. Using mechanised strategies to build and time your own portfolios, the private investor can achieve substantial risk-adjusted returns in excess of the ALSH index & most funds.

ALERTS

Get action-oriented email/SMS alerts based on robust research and analysis

AUTOMATION

Automate your money and risk management, receive stops and exposure values.

TRENDS

Catch trends as they emerge and benefit from superior market timing.

TRAINING

Gain access to training and

learn to trade like a pro.

GROW YOUR PORTFOLIO

Confidently grow your portfolio and out-perform fund managers year after year.

INSIGHTS

Gain markets insight via our unique user dashboard and proprietary research.

SAVETIME

Find high probability trading or long-term investment opportunities with a click of a button.

The only research house on the globe that provides JSE market breadth information to the public, Sharenet Analytics' clients use JSE-tailored systems and world-class analysis to out- perform professional fund managers and they do it without ever having to undertake any of the research themselves.

Trading and investing on your own takes time, it requires discipline and many hours of research and a dedicated following of the markets. But most people simply don't have the time and as a result, their portfolio performance is undermined. Sharenet Analytics makes trading simple and cuts down the time while adding to your portfolio returns. It's like trading with a team of analysts!

Hundreds of systems have been developed, each back tested to determine its individual track record, risk level and win/loss ratio. Only the very best models are published and their signals made available to clients.

Whether an investor or trader, whether you trade in CFDs, equities, indices or ETFs, Sharenet Analytics specialises in trading on the JSE and caters for all styles and philosophies. Pick and choose between over 10 systems and simply sit back and wait for their entry and exit signals. Also receive help from our integrated money management calculcator which will take emotions out of trading and help reduce risk while appropriating the optimum value to each trade. No more guessing, manage your exposure based on actuarial models.

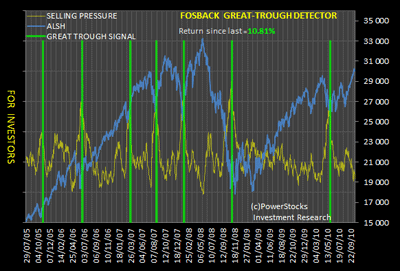

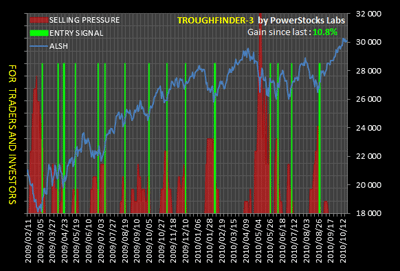

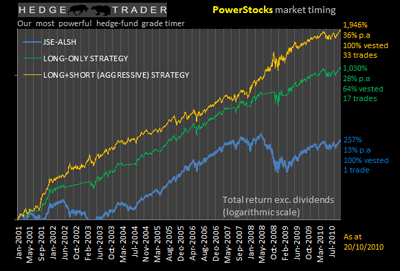

Our systems provide excellent entry points to traders and investors as illustrated by graph 1 and 2 below (click on the box number to pull up the corresponding graph) and the 3rd graph tracks 2 Sharenet Analytics' portfolio performances versus the performance of the ALSH over the last 5 years.

Sharenet Analytics boasts short-term traders like SWINGTRADER and TROUGH-TRADER which have gain/loss ratios of the order of 10:1 with an astonishing 85% win ratio and only trades roughly once per month!

These systems and many others are back tested and optimised for the South African market. Nowhere else will you be able to replicate or find a system as reliable and unique to the JSE.

A long-term "buy-on-the-dip" JSE trough detection system that marks the beginning of new intermediate bull markets lasting from 3-12 months.

It is very accurate but has only given 16 signals since 1997, roughly one signal per 9 months on average. Investors use it to load up their portfolios and traders use it to close shorts and open longs.

A short-term trough-detection system for mild corrections. It is used as an "all clear" signal by traders to start opening up individual equities long positions.

It is also used by investors that are placing regular amounts into the JSE (Rand-cost averaging) to optimise their timing of these placements. It has given 15 signals since March 2009, roughly 1 signal per month on average.

A medium-term JSE trading strategy, which plays long, as well as short positions and trades on average once every 100 days.

Its mandate is to stay long in the JSE for as long as possible but to exit and short major corrections and bear markets. In the last 10 years it has made 17 long and 16 short trades and comprehensively out-performed the JSE buy+hold strategy.

Combining Advanced Charts with Analytics is highly recommended as it allows important analytics indicators to be drawn and/or overlaid with other instruments in your charts, and JSW Online trading opportunity lists are also integrated into Advanced Charts to allow you to quickly scroll through the days' opportunities to find your perfect trading candidate. Additionally, it allows you real-time access to about 10 chart templates and trading models that are personally maintained with annotations and commentary by the Analytics team.

For information contact one of our analysts at +27 21 700 4800